The problem's appear to have started back in 2022.

About one-third of people with loans on their vehicle are underwater. Meaning, if the car gets totaled, they have to continue making payments for a vehicle that doesn't exist.

About one-third of people with loans on their vehicle owe more than it's worth. Economists call this negative equity. And it is not affecting just owners of luxury band vehicles. The cost of the loan exceeding the cost of the car appears to be across the board. And more Americans are taking out loans for longer in an effort to reduce monthly payments. But economists say this is also a predictor of potential defaults on those loans.

Negative equity also appears to be the result of a dramatic decline in used-car prices in recent years. The problem of underwater loans particularly affects people who have taken them out since 2022.

Experts suggest you shop around for deals, although they are difficult to find now days, conduct regular maintenance on your current vehicle to help with trade-in value, and consider vehicles with proven higher resale values.

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

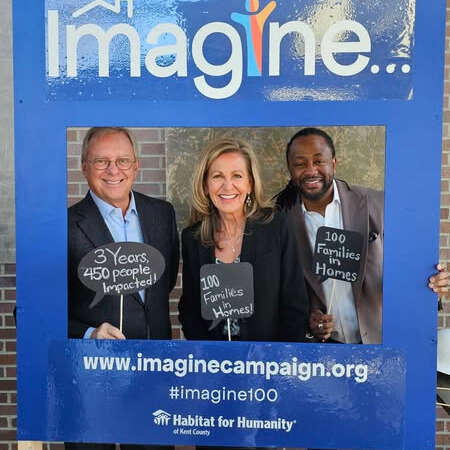

03/25/25 - Habitat Kent County Plans Major Housing Project

03/25/25 - Habitat Kent County Plans Major Housing Project