Prices for items we use everyday have been going up. The markets reacted negatively due to the new numbers.

Inflation hit rates not seen since the 1980's.

The Consumer Price Index, the leading indicator of prices of household goods and services most people use, has increased 7.5%, a rate higher than anticipated. This was the steepest annual price increase since 1982. Consumer prices went up .6% in January, signifying that costs for products remained the same as December, and not dropping as many had hoped.

The significant increase in inflation appears to have wiped out any pay increases seen over the last year.

The markets reacted immediately with all the Dow, S&P, and the NASDAQ all falling with significant losses at the open.

The rate increases could also signify that the Federal Reserve may have to hike interest rates sooner than anticipated.

02/19/26 - Cornerstone University Announces New Approach in Education

02/19/26 - Cornerstone University Announces New Approach in Education

01/09/26 - 4 in 10 Kids in Kent County are Overweight or Obese

01/09/26 - 4 in 10 Kids in Kent County are Overweight or Obese

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

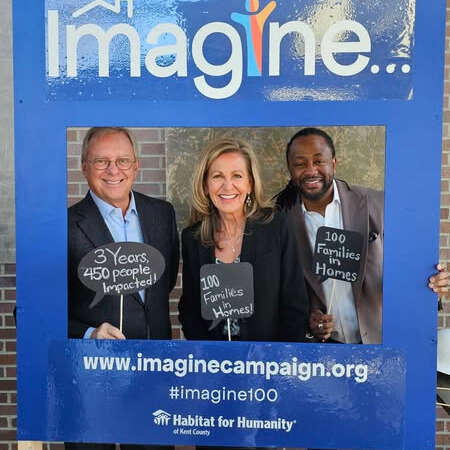

03/25/25 - Habitat Kent County Plans Major Housing Project

03/25/25 - Habitat Kent County Plans Major Housing Project