The Fed raises interest rates 0.25% as they continue to work at bringing down inflation.

(WASHINGTON D.C.) - The Federal Reserve on Wednesday raised its short-term borrowing rate another 0.25%, despite concern that previous rate increases helped trigger the nation's banking crisis.

In a statement, the Fed rejected concerns about the financial system. "The U.S. banking system is sound and resilient," the central bank said.

Nearly 190 banks are at risk of collapse amid high interest rates and declining asset values, according to a study that was released by a team of university researchers earlier this month.

Some observers had urged the central bank to pause its rate hikes, as least temporarily, in order to assess the fallout from the collapse of Silicon Valley Bank and Signature Bank earlier this month.

A survey by Bloomberg last week found that most economists expected the Fed to raise interest rates by 0.25% on Wednesday, matching the increase that the central bank imposed at its most recent meeting last month.

Over the last year, the Fed has raised its benchmark interest rate by 4.5%, the fastest pace since the 1980s.

Fed policymakers are not projecting a recession. Many project the economy to grow 0.4% this year and expect the unemployment rate to climb to 4.5%.

02/19/26 - Cornerstone University Announces New Approach in Education

02/19/26 - Cornerstone University Announces New Approach in Education

01/09/26 - 4 in 10 Kids in Kent County are Overweight or Obese

01/09/26 - 4 in 10 Kids in Kent County are Overweight or Obese

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

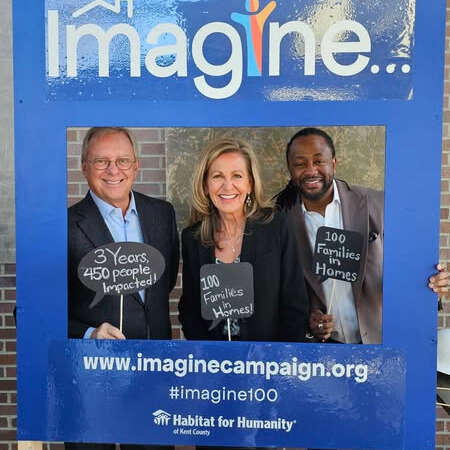

03/25/25 - Habitat Kent County Plans Major Housing Project

03/25/25 - Habitat Kent County Plans Major Housing Project