The Internal Revenue Service today reminded millions of last-minute tax filers that the agency has a variety of free tools and resources available on IRS.gov.

(Positive Prep) - Today (Monday) is the tax deadline, and if you haven't already filed your taxes, don't worry, you still have a little time! The official deadline for filing your federal income tax return is midnight, but if you need even more time to get everything together, you can file for an extension, which will give you until October 15 to file your tax return. It is important to note that filing an extension doesn't give you more time to pay your taxes if you owe the IRS, so make sure to pay by the due date to avoid potential penalties and interest.

If you're trying to finish your taxes today, take a deep breath. You've got this! Make sure to double-check everything for accuracy and completeness, as mistakes can cause delays and even penalties. If you're feeling overwhelmed, consider seeking help from a tax professional or using tax preparation software to guide you through the process.

The most efficient way to file your return is to go to irs.gov and us the "e-file", which is available to all tax payers.

Tax day is upon us, and whether you're getting a sweet refund or having to pay up, there's no reason you can't celebrate being done with your taxes. To make things even better, some restaurants and retailers are offering promotions to help you do just that. Just be sure to check if your nearest location is participating before you head out to claim your prize.

-

Krispy Kreme guests who buy an assorted or glazed dozen at regular price can get a another dozen and only pay the sales tax on a second dozen.

-

Kona Ice is hosting a “Chill Out Day” with a free cup of shaved ice at participating trucks.

-

Grubhub is offering $15 off delivery orders of more than $25. Just use the promo code TAXBREAK at checkout.

-

Potbelly shops are offering a free Original Sandwich with the purchase of any Original or Big sized Sandwich. Use the promo code BOGO.

-

Office Depot and Office Max are offering free shredding for up to 5 pounds of documents now through April 27. You can download the coupon on their website.

For those who owe a payment with their tax return, the IRS has a number of payment options.

For taxpayers that are unable to pay in full by the tax deadline, the IRS recommends they should file their tax return and pay what they can, and apply for an online payment plan. By filing by the deadline, taxpayers will avoid failure to file penalties and interest – even if they’re unable to pay. Taxpayers can explore various payments options; they can receive an immediate response of payment plan acceptance or denial without calling or writing to the IRS. Online payment plan options include:

- Short-term payment plan – The total balance owed is less than $100,000 in combined tax, penalties and interest. Additional time of up to 180 days to pay the balance in full.

- Long-term payment plan – The total balance owed is less than $50,000 in combined tax, penalties and interest. Pay in monthly payments for up to 72 months. Payments may be set up using direct debit (automatic bank withdraw) which eliminates the need to send in a payment each month, saving postage costs and reducing the chance of default. For balances between $25,000 and $50,000, direct debit is required.

Though interest and late-payment penalties continue to accrue on any unpaid taxes after April 15, the failure to pay penalty is cut in half while an installment agreement is in effect. Find more information about the costs of payment plans on the IRS’ Additional information on payment plans webpage.

4/18/25 - List of Easter Events for the Kids

4/18/25 - List of Easter Events for the Kids

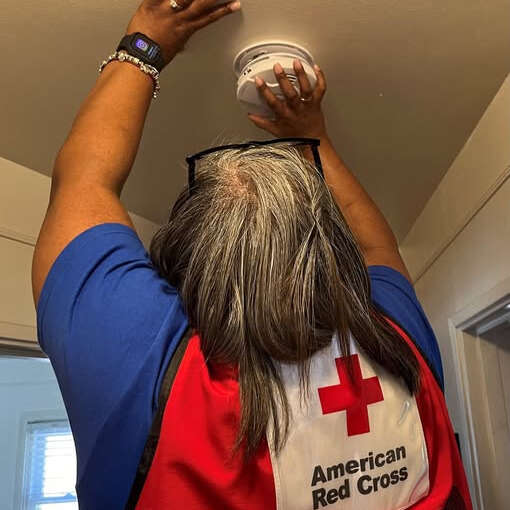

04/15/25 - Red Cross Going Door to Door This Month

04/15/25 - Red Cross Going Door to Door This Month

11/06/24 - ELECTION 2024 - ELECTION RESULTS

11/06/24 - ELECTION 2024 - ELECTION RESULTS

8/15/24 - Groundbreaking For New Children's Rehab Hospital

8/15/24 - Groundbreaking For New Children's Rehab Hospital