The Governor has signed a bill that imposes a hotel excise tax, and allows for further expansion of the tax, that could fund future projects in Grand Rapids.

Governor Gretchen Whitmer signed a new law that could impact Grand Rapids taxes.

Under House Bill 5048, Grand Rapids could impose a 2% hotel tax, but it would still need voter approval. The bill also allows the county to extend that tax from 5 to 8%. The funds could be allocated to proposed projects such as an amphitheater and a soccer stadium in downtown Grand Rapid. Voters could decide on the tax as soon as the August primary.

Proponents of the bill, which passed with bi-partisan approval in the state legislature in November, say it will add revenue from outside residents who attend events, conferences, or vacation in the area.

01/09/26 - 4 in 10 Kids in Kent County are Overweight or Obese

01/09/26 - 4 in 10 Kids in Kent County are Overweight or Obese

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

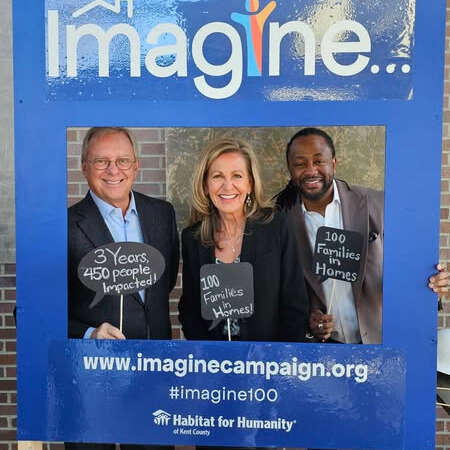

03/25/25 - Habitat Kent County Plans Major Housing Project

03/25/25 - Habitat Kent County Plans Major Housing Project