Some student loans could have their interest rates cut to 0%.

-Congressional Democrats this week introduced legislation that would immediately cut interest rates to 0% for all 44 million student loan borrowers in the United States.

The Student Loan Interest Elimination Act would cover current borrowers. Future borrowers would be impacted by interest but through a different system. It could involve a “sliding scale” based on financial need. some borrowers could still have 0% on their interest but not student would get an interest rate higher than 4%.

The measure would also establish a trust fund where interest payments would go for the student loan program’s administrative expenses.

Student loan interest payments are set to restart in September after a three-year pause began under the COVID-19 pandemic.

The legislation comes less than a month after the U.S. Supreme Court struck down Pres. Biden’s previous student loan forgiveness plan, which would have provided debt relief of up to $10,000 for most federal borrowers and up to $20,000 for Pell Grant recipients. Republicans hailed the ruling as a just outcome, while Democrats have been pressing for more options to protect borrowers.

07/07/25 - Relief Agencies Work to Provide Disaster Relief

07/07/25 - Relief Agencies Work to Provide Disaster Relief

07/01/20225 - Festivals, Parades, and Fireworks are scheduled this week to celebrate independence.

07/01/20225 - Festivals, Parades, and Fireworks are scheduled this week to celebrate independence.

06/30/25 - Kent County Man Drowns in Wabassis Lake; Sheriffs Remind Residents of Boating Safety

06/30/25 - Kent County Man Drowns in Wabassis Lake; Sheriffs Remind Residents of Boating Safety

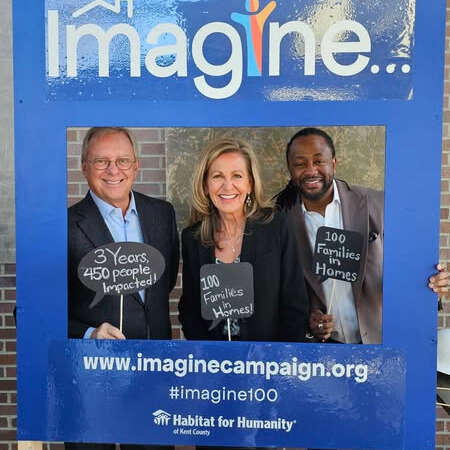

03/25/25 - Habitat Kent County Plans Major Housing Project

03/25/25 - Habitat Kent County Plans Major Housing Project