The massive tax cut is more than likely to see a veto from the Governor's office.

Michigan Senate Republicans have put forward their 2.5 billion dollar tax cut proposal that's more likely to receive a veto from Governor Gretchen Whitmer.

Senate leaders say the cuts would enable Michigan families to have more money to spend.Senator Doug Wozniak of Shelby Township believes the money should be returned to the tax payers.

“This is a historic effort to help Michigan residents keep more of what they have earned,” said Wozniak. “We don’t need more government; Michiganders need more money for everyday essentials and this bill provides all taxpayers with much-needed relief.”

The plan would also expand the income tax deduction for, both, working and retired seniors from a maximum of $20,000 up to $40,000 for individuals, and from a maximum of $40,000 up to $80,000 for couples and lowering the age of eligibility from 67 to 62 years of age.

The bill also creates a $500 per child tax credit for families with children 19 years and younger.

The Governor's office released a statement this afternoon. Governor Whitmer says the cuts would eventually catch up and reduce spending on schools, roads, and public safety.

The measure goes to the Governor's office. No word on when her decision will be handed down.

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

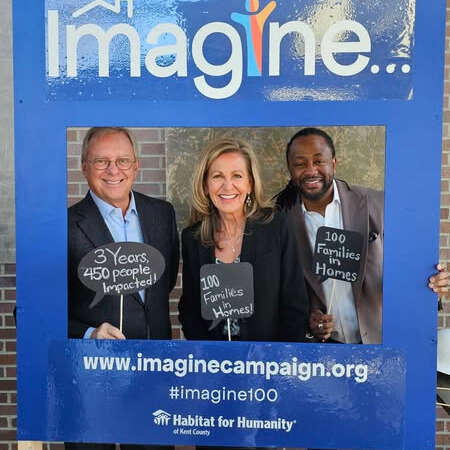

03/25/25 - Habitat Kent County Plans Major Housing Project

03/25/25 - Habitat Kent County Plans Major Housing Project