The Fed's policy-making committee meeting ends Wednesday and that could mean another interest rate hike.

WASHINGTON (Reuters) - With the Federal Reserve expected to hike its key interest rate by three-quarters of a percentage point on Wednesday to battle high inflation, focus will shift to how deeply signs of an economic slowdown have registered with its policymakers.

The anticipated increase in the target federal funds rate, the Fed's key tool in trying to lower inflation from a four-decade high, will bring the U.S. central bank to a mile marker of sorts as it reaches a level of around 2.4% that is estimated to no longer encourage economic activity.

That will represent one of the fastest-ever gear changes in U.S. monetary policy - just over four months ago the policy rate was near zero and the Fed was buying billions of dollars of bonds each month to help the economy recover from the COVID-19 pandemic.

But while there has been little progress registered yet in the inflation fight, signs of economic stress are accumulating - and raising the stakes for Fed officials as they weigh just how much tighter monetary policy needs to be to slow price increases against the risk that going too far could trigger a recession.

As the Fed's impact on the economy becomes more apparent, the issue now is whether it is at risk of overdoing it.

Parts of the U.S. bond market are signaling an increased likelihood of recession, with yields on 2-year U.S. Treasury notes now higher than they are for 10-year Treasuries, a possible sign of lost faith in near-term economic growth and reflecting a possibility the Fed may be forced to cut rates within a relatively short span of time.

Fed policymakers will not issue new economic projections of their own on Wednesday. But a new policy statement due to be released at 2 p.m. EDT (1800 GMT) and Fed Chair Jerome Powell's news conference half an hour later should elaborate on how the central bank views the recent economic data and at least hint at its next steps.

That will almost certainly include another interest rate increase at the Fed's next policy meeting in September, with upcoming inflation data likely to shape whether officials opt for another 75-basis-point increase, or scale back to a half-percentage-point move.

With consumer prices rising at a more than a 9% annual rate as of June, "the Fed will not slow the pace of hikes until they are convinced inflation has turned," Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote recently.

8/5/24 - Flights Impacted Because Of Hurricane Debby

8/5/24 - Flights Impacted Because Of Hurricane Debby

8/2/24 - U.S. / Russia Prisoner Exchange

8/2/24 - U.S. / Russia Prisoner Exchange

7/31/24 - Lawmakers Consider Child Safety Bill

7/31/24 - Lawmakers Consider Child Safety Bill

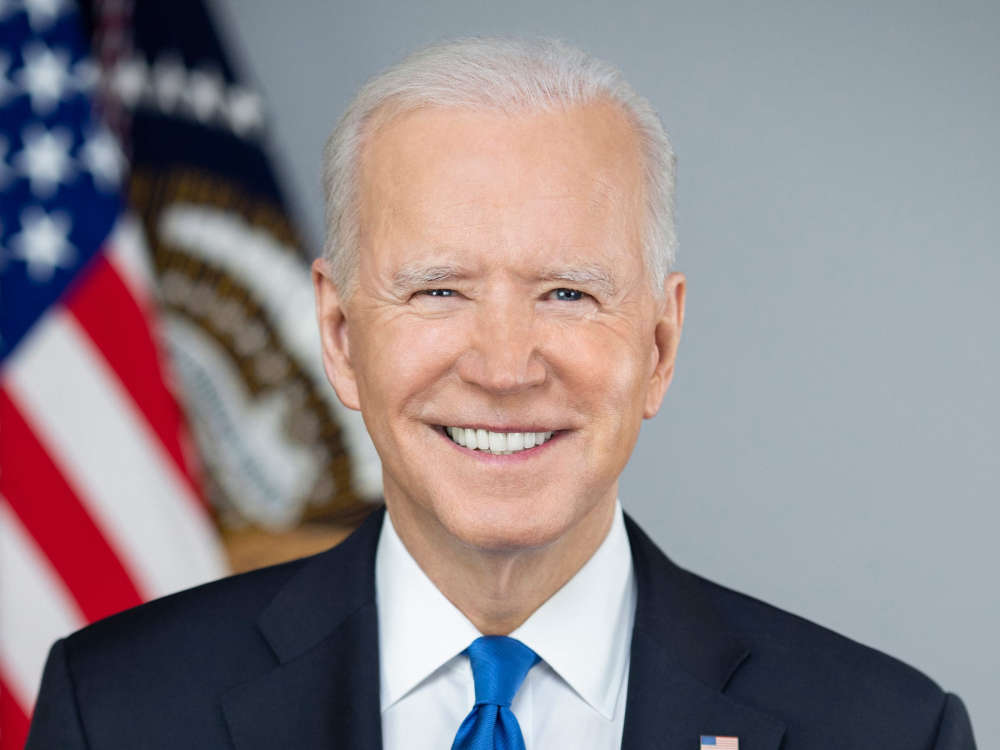

7/22/24 - President Biden Drops Out Of Presidential Race

7/22/24 - President Biden Drops Out Of Presidential Race