Advocates of child tax credit payments argue the monthly payments make more sense for low-income families, but middle-income families are also benefiting.

(WZZM) - The second installment of the advance child tax credit payment is set to hit bank accounts via direct deposit, and through the mail, on Friday.

The credit is $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17. Eligible families will receive $300 monthly for each child under 6 and $250 per older child.

The first payment went out on July 15, for those with eligible children who did not opt-out. The payments will happen each month on the 15th through December. But August 15 falls on a weekend, so payments are being moved up a couple of days. The payments are going out to tens of millions of Americans, so don't be surprised if it takes a day or two to show up.

In the past, eligible families got a credit after filing their taxes — either as a lump-sum payment or a credit against taxes owed. But now six months of payments are being advanced monthly through the end of the year. A recipient receives the second half when they file their taxes.

Advocates argue the monthly payments make more sense for low-income families.

“One of the problems with the big check in a year, if your car broke six months before, that is a long time to wait,” said Michael Reinke, executive director of the Nashua Soup Kitchen & Shelter, which serves many families making less than $26,000 a year.

“When people have money over a consistent period of time, it's easier to make sure it's going to the expenses you really need,” he said. “Sometimes, if you get it all at once, it's hard to budget.”

The benefits begin to phase out at incomes of $75,000 for individuals, $112,500 for heads of household and $150,000 for married couples. Families with incomes up to $200,000 for individuals and $400,000 for married couples can still receive the previous $2,000 credit.

If all the money goes out, the expectation is that could significantly reduce poverty — with one study estimating it could cut child poverty by 45%.

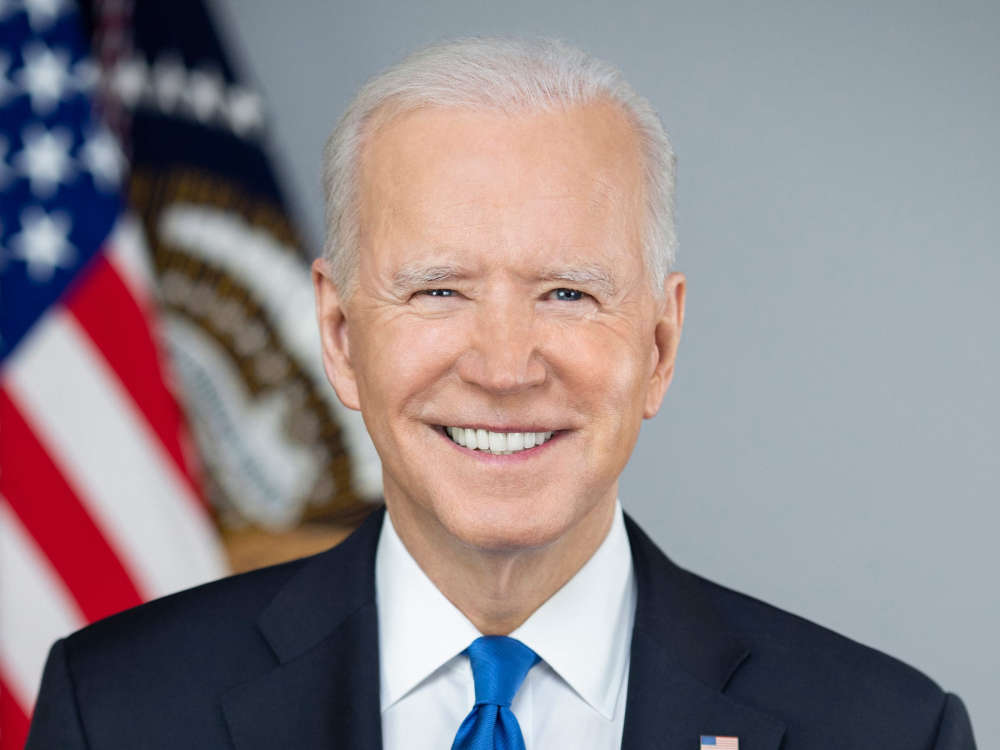

The payments are also a test case of sorts. President Joe Biden ultimately would like to make them permanent — and the impact they have could go a long way to shaping that debate this year.

Under a $3.5 trillion budget resolution introduced by Senate Democrats Monday, the tax credit would be extended beyond its current 2022 expiration.

8/5/24 - Flights Impacted Because Of Hurricane Debby

8/5/24 - Flights Impacted Because Of Hurricane Debby

8/2/24 - U.S. / Russia Prisoner Exchange

8/2/24 - U.S. / Russia Prisoner Exchange

7/31/24 - Lawmakers Consider Child Safety Bill

7/31/24 - Lawmakers Consider Child Safety Bill

7/22/24 - President Biden Drops Out Of Presidential Race

7/22/24 - President Biden Drops Out Of Presidential Race