The Michigan House and Senate are advancing bills that would provide tax credits to residents who contributed to a scholarship for students to use on alternative or supplemental education.

(The Detroit News) - The bills, introduced last Thursday, passed quickly Tuesday morning through House and Senate education committees.

Since the bill packages are separate, one or the other will have to be approved by the opposite chamber in the coming days before heading to Gov. Gretchen Whitmer's desk, where it is likely to receive a cold welcome.

Critics argue the scholarship program amounts to an unconstitutional voucher program, while supporters maintain the alternative education opportunities are essential after a year of remote learning. The Michigan Constitution bans spending public money directly or indirectly on private schools.

Whitmer's office called the legislation a "non-starter" that violates Michigan's constitutional protections for public school funds.

House Republicans have said 28 states have successfully adopted similar programs to the one approved Tuesday. An expert said earlier Tuesday Michigan essentially is "landlocked" by states with either a voucher or tax-incentivized program.

Rep. Bryan Posthumus, R-Cannon Township, argued the legislation wouldn't violate the Blaine Amendment because the money would go to scholarship-granting organizations and not directly to private schools. He said the income eligibility requirements in the bill give at-risk students a chance at opportunities usually afforded to students from families with more income.

"For too long here in Michigan, we’ve allowed zip codes and parents’ wealth to determine the educational opportunities for kids," said Posthumus,

Under the legislation, individuals could contribute money toward scholarship-granting organizations under the Student Opportunity Scholarship program for which they would receive a tax credit. The program would be capped at $500 million in contributions each year.

To receive a scholarship from the fund, a student would have to be in a household with an income under 200% of the financial eligibility for free or reduced lunch, have some sort of disability, be in the foster care system or have someone else in their household receiving funds through the Student Opportunity Scholarship program.

The funds could be used on tuition or fees for public or nonpublic education or online learning programs, tutoring, extracurricular programs, textbooks or instructional materials, computer hardware, uniforms, standardized test fees, summer school, after-school programs or child care, dual enrollment, transportation, sports fees or career or technical programs.

For nonpublic school students, the funding would be capped at 90% of the minimum foundation allowance spent on public school students, minus three-eights of the percentage that the household income exceeds free or reduced lunch eligibility criteria. For a nonpublic school student with a disability, scholarship amounts would be capped at 90% of the minimum foundation allowance without consideration of household income.

Nonprofits wishing to participate in the program would apply to the Michigan Department of Treasury for certification and renewal as a scholarship-granting organization. The application would need to include proof of their nonprofit status and descriptions of how they would determine eligible students, the application process used for interested students and the process the nonprofit would use to approve education service providers for the program.

To receive certification or renew certification for a scholarship-granting organization, the Treasury Department would need to ensure the nonprofit could or did allocate 90% of the scholarship funds it received, maintain separate accounts for the scholarship funds and operating budgets, and used two or more education service providers in administering scholarship funds.

The nonprofits could keep no more than 10% of the scholarship funds for administrative expenses.

The tax credits would mean up to $500 million a year less in the state general fund and some losses from the school aid fund, as well as the possibility that more students and funding leave public schools for nonpublic institutions.

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

09/05/25 - Frederick Meijer Gardens Sees 'Enlightenment' Return

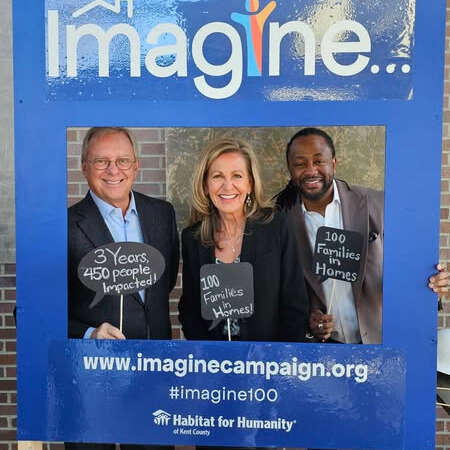

03/25/25 - Habitat Kent County Plans Major Housing Project

03/25/25 - Habitat Kent County Plans Major Housing Project